Discover how AI agents automate business tasks, enhance efficiency, and optimize global trade. Learn how EximGPT changes AI-driven trade operations.

In 2025, the geopolitical narrative of a "Trade War" has undergone a fundamental phase shift. While high-level rhetoric focuses on aggregate trade volumes, technical reality reveals a Macro-Micro Paradox. On paper, the US and China have achieved significant "functional decoupling," with bilateral trade now representing less than 3% of their respective GDPs.

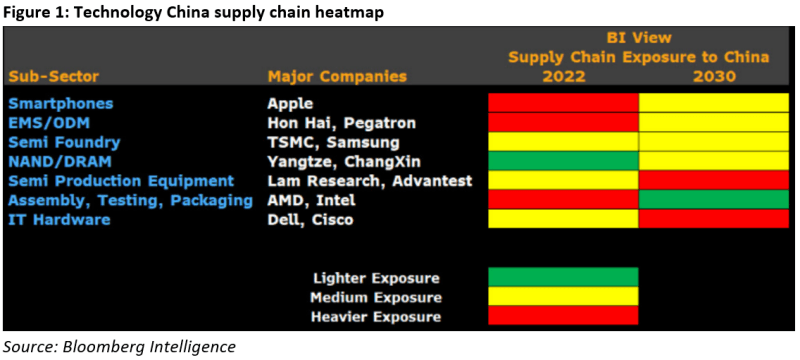

However, a deep-dive technical audit reveals a US-China Micro-Dependency that fiscal policy and broad tariffs have failed to mitigate. The US Defense Industrial Base (DIB) remains tethered to specific Chinese industrial nodes—specifically in UAV (Unmanned Aerial Vehicle) components and Rare Earth Element (REE) processing—that constitute a strategic single point of failure.

To quantify the current "interdependence risk," we must analyze the Import/Export-to-GDP Exposure Ratio. Recent 2024-2025 data suggests that both nations are successfully insulating their broader economies from bilateral shocks.

The US has effectively diversified its "broad-basket" consumer imports through the USMCA and alternative ASEAN sourcing.

China’s strategy to prioritize internal consumption while maintaining external demand has reduced its reliance on the US market.

The danger lies not in the volume of trade, but in the concentration of critical nodes. The US-China Micro-Dependency is currently anchored in four high-alpha sectors that underpin modern warfare and green energy.

Despite tariffs reaching 170% in 2025, the US commercial and tactical drone market maintains an 80-90% reliance on Chinese OEMs like DJI and Autel.

The US faces a "Processing Paradox." While the US mines significant REE ore (45 kilotons in 2024), it lack the chemical infrastructure to refine it.

Category | US Import Reliance | Global Processing Control (China) |

REE Compounds | 70-77% | ~90% |

Permanent Magnets | 70-80% | >94% |

Heat-Resistant Precursors | >99% | >99% |

Technical Chokepoint: China controls the solvent extraction and magnetization phases. Even magnets sourced from third-party nations often use Chinese-refined high-purity oxides or heat-resistant precursors.

In systems engineering, a 1.6% macro-dependency can lead to a 100% production stoppage if the dependency sits on the Critical Path. Using a simulation logic, we can see how an export restriction on a single component—like a Neodymium magnet—nullifies billions in defense spending.

Python

def check_production_viability(bom_list): """

Evaluates if a defense asset can be produced

based on current micro-dependency restrictions. """ for component in bom_list: if component['origin'] == 'China' and component['restriction_index'] > 0.8: return f"SYSTEM HALT: {component['name']} (Micro-Dependency) is blocked." return "Production Green."# Example: F-35 / Tactical Drone Component Logic

asset_bom = [ {'name': 'Carbon Fiber Shell', 'origin': 'USA', 'restriction_index': 0.1}, {'name': 'NdFeB Magnets', 'origin': 'China', 'restriction_index': 0.95}, {'name': 'Gallium-Nitride Amp', 'origin': 'Japan', 'restriction_index': 0.3}

]

print(check_production_viability(asset_bom))

The US-China Micro-Dependency proves that aggregate trade data is a lagging indicator of national security. While the US has successfully moved "the bulk" of its trade away from China, it has yet to secure the "brain and heart" of its advanced manufacturing. Without a dedicated "Mine-to-Magnet" domestic pipeline and a surge in UAV component fabrication, the US remains tactically vulnerable to targeted export controls.

Are you looking to secure your supply chain against micro-dependency risks? Would you like me to generate a Comparative Audit of current US-based REE facilities versus Chinese State-Owned Enterprises to identify your most vulnerable procurement nodes?

🚀 Want to see how AI can transform your global trade business? Try EximGPT for free today.

Related post:

Discover how AI agents automate business tasks, enhance efficiency, and optimize global trade. Learn how EximGPT changes AI-driven trade operations.

Learn how EximGPT helps businesses research tariffs, analyze trade impacts, and streamline compliance for smarter international trade planning

Avoid costly export classification mistakes! Learn the top 7 errors businesses make and how to ensure compliance for seamless global trade

Discover how AI is transforming global trade with email automation, AI lead generation, and smart compliance solutions. Stay ahead with EximGPT.

We use cookies

We use cookies to improve your experience, analyse traffic, and deliver personalised content and ads. Essential cookies for security and core functionality are always enabled. By clicking "Accept", you consent to our use of additional cookies.

For more information, see our privacy policy.