Avoid costly export classification mistakes! Learn the top 7 errors businesses make and how to ensure compliance for seamless global trade

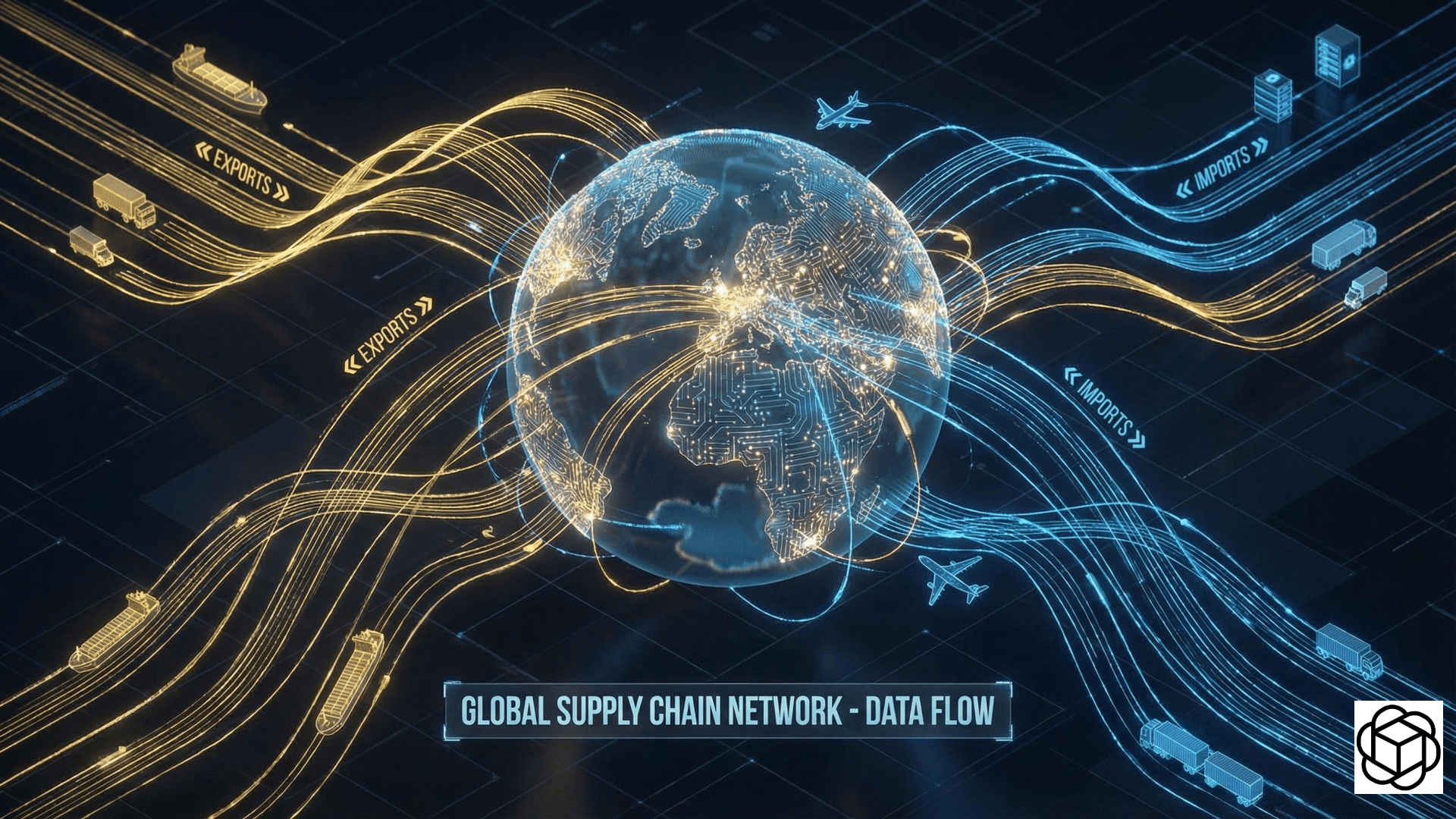

In global logistics, conflating 'export vs import' protocols isn't just a semantic error—it’s a compliance risk that can freeze your supply chain.

A miscalculation in landed cost or a misunderstood Incoterm can wipe out profit margins before your goods even leave the port. This technical analysis moves beyond the dictionary definitions to dissect the regulatory, financial, and operational mechanics that separate import flows from export strategies. In the domain of macroeconomic strategy and supply chain management, the distinction between export vs import extends far beyond simple transaction directions. It encompasses complex regulatory frameworks, currency arbitrage, and logistical protocols defined by International Commercial Terms (Incoterms).

For technical stakeholders, understanding the granular mechanics—from Harmonized System (HS) code classification to landed cost analysis—is essential for optimizing cross-border operations. This analysis deconstructs the operational difference between import and export trade.

To optimize supply chain latency and cost efficiency, stakeholders must distinguish the directional vectors of trade. The following matrix contrasts the technical obligations of the two modalities.

Operational Metric | Export Protocol | Import Protocol |

Vector Direction | Outbound (Domestic $\to$ Foreign) | Inbound (Foreign $\to$ Domestic) |

Economic Indicator | Credit item in Balance of Payments (BOP). | Debit item in Balance of Payments (BOP). |

Regulatory Burden | Export Control Classification Number (ECCN) compliance. | Customs clearance, Duty drawback, and Tariff payments. |

Risk Profile | Credit risk (non-payment), currency appreciation. | Quality control risk, currency depreciation, landed cost variance. |

Exporting requires rigorous adherence to the Export Administration Regulations (EAR). The technical workflow begins with classifying goods using the correct Schedule B number or HS Code to determine licensing requirements.

The crucial differentiator in export logistics is the Incoterm selected.

Visual Concept: A chart showing the transfer of risk from Seller to Buyer based on different Incoterms.

Alt Text: Bar chart illustrating risk transfer points for Incoterms 2020, comparing EXW, FOB, CIF, and DDP in export vs import scenarios.

The complexity of the difference between import and export trade is most visible in cost accounting. Importing involves calculating the Total Landed Cost, which aggregates the unit price, freight, insurance, customs duties, and port handling fees.

Failure to accurately calculate landed cost results in margin erosion. Technical teams often automate this calculation to predict profitability under fluctuating tariff regimes.

For data analysts working in logistics, calculating the true impact of an import involves summing variable surcharges. Below is a Python snippet often used in ERP scripting to estimate Landed Cost per Unit (LCPU).

Python

def calculate_landed_cost(unit_price, quantity, freight_cost, duty_rate, insurance): """ Calculates the Total Landed Cost for an import shipment. Args: unit_price (float): FOB price per unit. quantity (int): Number of units. freight_cost (float): Total shipping cost. duty_rate (float): Customs duty percentage (e.g., 0.15 for 15%). insurance (float): Insurance premium. Returns: float: Landed Cost Per Unit. """ subtotal = unit_price * quantity duties = subtotal * duty_rate total_cost = subtotal + freight_cost + duties + insurance return round(total_cost / quantity, 2) # Example Usage print(f"Landed Cost: ${calculate_landed_cost(50.00, 1000, 2500.00, 0.05, 150.00)}")

At a macroeconomic level, the relationship between these two flows defines the Balance of Trade (BoT).

$$BoT = Value_{Exports} - Value_{Imports}$$

While a deficit is often viewed negatively in political discourse, in a technical economic context, it may signal robust industrial demand for foreign raw materials required for value-added production.

The primary difference lies in compliance focus: Exports focus on "Denied Party Screening" and export licensing (EAR), while imports focus on valuation, HS code classification, and duty payments to Customs.

Incoterms dictate who pays for freight and insurance. For example, in an FOB (Free on Board) export, the buyer (importer) pays for the main carriage, whereas in a CIF (Cost, Insurance, and Freight) export, the seller (exporter) pays.

Calculating landed cost is critical because the FOB purchase price is only a fraction of the total cost. Ignoring freight, duties, and port fees can lead to selling imported goods at a loss.

Stop Guessing Your Landed Costs! Global trade margins are too thin for estimation errors. If you are ready to audit your current import/export workflows for compliance gaps and cost leakage, we can help.

Avoid costly export classification mistakes! Learn the top 7 errors businesses make and how to ensure compliance for seamless global trade

Master the difference between import vs export in international trade. Understand customs, compliance, and leveraging global solutions for profit.

In reality, depending only on general AI leads to major issues: inaccurate data, misguided strategies, and even lost business opportunities...

Email automation refers to the use of software to send pre-scheduled, targeted, and personalized emails to customers and prospects....

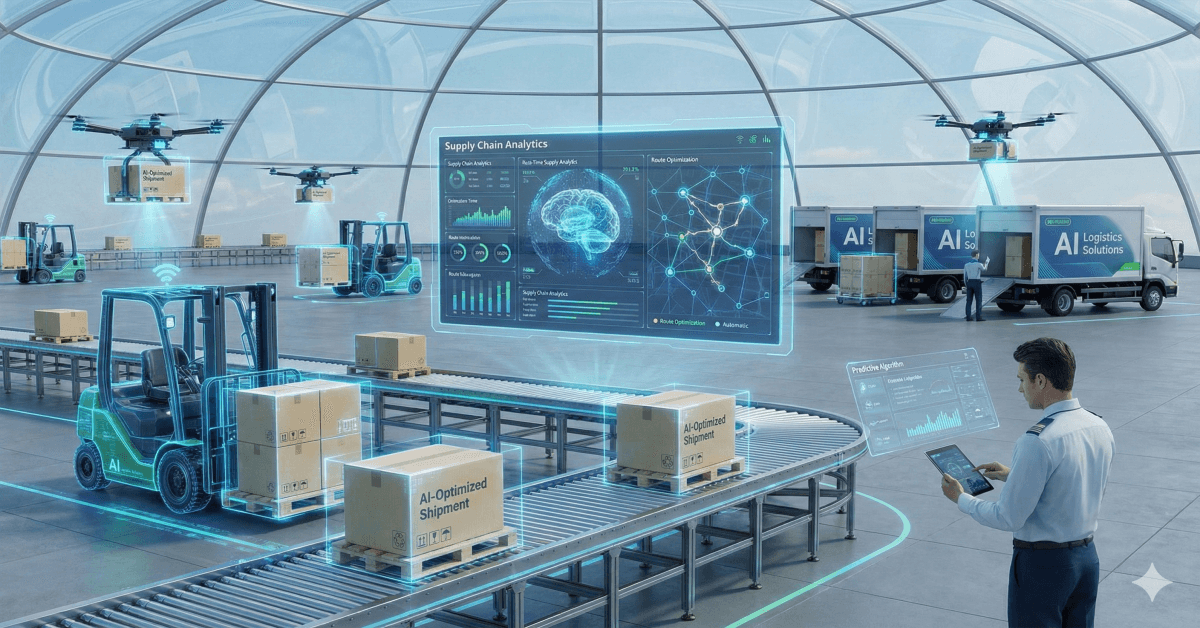

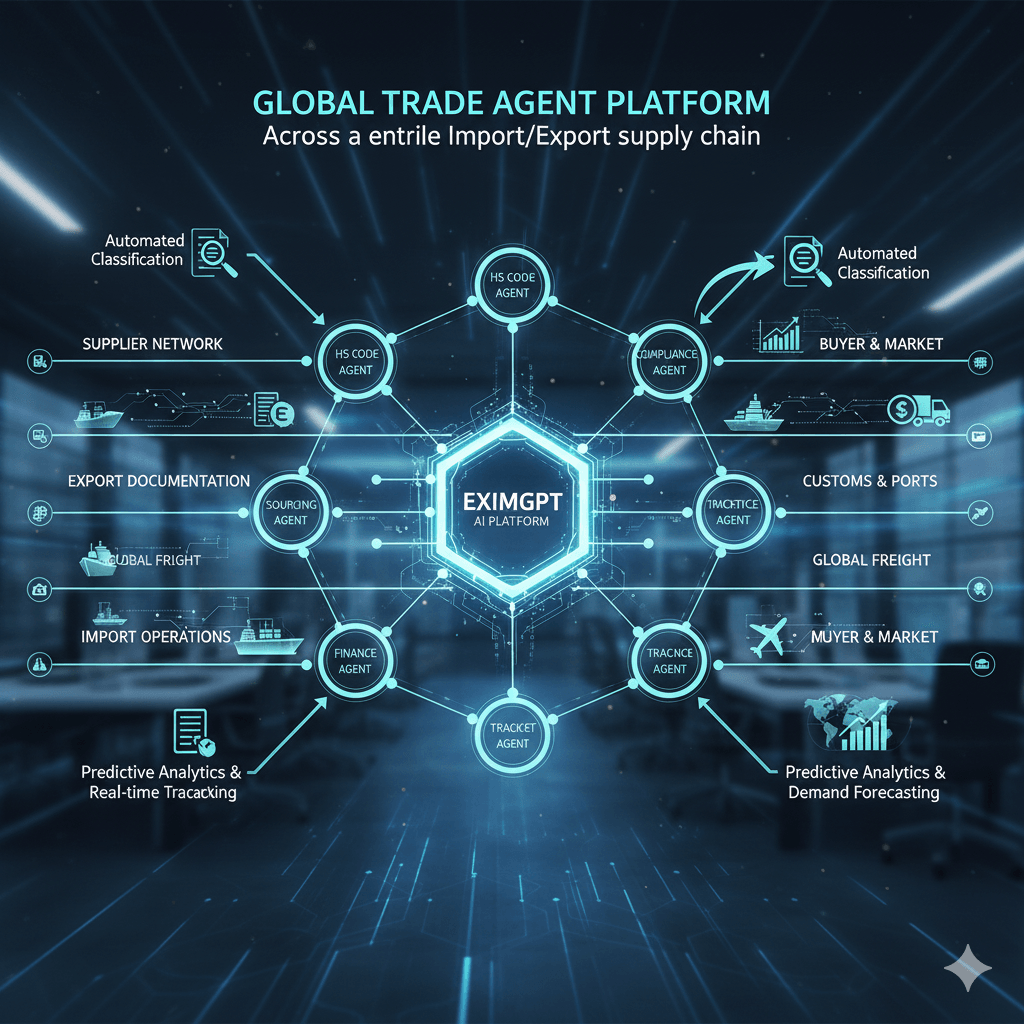

Eximgpt’s Agent Platform uses AI Modelling. Optimize costs, enhance decisions, and achieve sustainable growth with this cutting-edge AI technology.

We use cookies

We use cookies to improve your experience, analyse traffic, and deliver personalised content and ads. Essential cookies for security and core functionality are always enabled. By clicking "Accept", you consent to our use of additional cookies.

For more information, see our privacy policy.