Discover how AI is transforming global trade with email automation, AI lead generation, and smart compliance solutions. Stay ahead with EximGPT.

Import vs Export: Navigating Global Trade and Compliance

Import vs export—these two terms form the fundamental basis of international trade. While seemingly straightforward, mastering the differences in procedures, compliance, and strategic implications is crucial for any business seeking profitable expansion in the global marketplace. Understanding these distinctions is the first step toward leveraging modern global solutions to streamline your supply chain and maximize profit margins. This guide provides an authoritative deep dive into the world of import vs export, compliance, and the critical role of technology in bridging the gaps.

Understanding import and export

1. Understanding the Core: Import vs Export Definitions

At its simplest, import vs export describes the flow of goods across national borders:

- Import: Goods or services brought into a country from a foreign country. For businesses, this involves navigating domestic regulations, tariffs, and us customs regulations.

- Export: Goods or services sent out of a country to a foreign country. This process requires adherence to the selling country’s export procedures and the buying country’s import rules.

The sheer complexity surrounding documentation, tariffs, and logistics makes both processes challenging, demanding specialized knowledge in international trade compliance.

1.1. The Legal Framework: Compliance Requirements in Import vs Export

Compliance differs dramatically depending on which side of the transaction you are on.

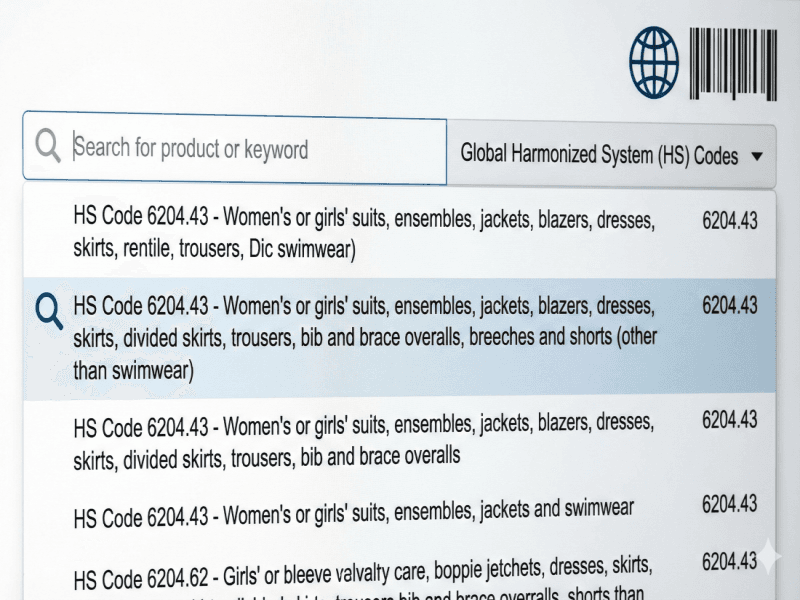

- Import Compliance: Primarily focused on valuation (correctly declaring the value of import goods to calculate duties), classification (find HS code), country of origin marking, and adherence to specific agency rules (FDA, FCC, etc.). Failure here can result in hefty fines and potential seizures when you go through customs.

- Export Compliance: Focused on ensuring the item is not restricted for sale to the destination country (e.g., sanction checks) and adherence to export procedures like filing Electronic Export Information (EEI). This minimizes risks for the export shipper.

2. Navigating the Trade Landscape: Tariffs and Trade Barriers

A key differentiator when analyzing import vs export risk is the impact of government intervention:

2.1. The Role of Tariffs and Duties in Import vs Export

Tariffs are taxes imposed by a government on import goods or services.

- Imports: Duties are a direct cost. Businesses must accurately utilize the correct find HS code to determine the applicable customs duties and tariffs. Misclassification can lead to unexpected costs or delays.

- Exports: Generally, countries do not impose taxes on goods leaving, but the buyer's country will impose the import tariff. Exporters must be aware of these costs to provide competitive pricing. This highlights the foundational difference in risk calculation between import vs export.

2.2. Mitigating Trade Barriers in International Trade

Both importers and exporters must navigate trade barriers. This concept encapsulates factors that restrict or impede international trade.

- Non-Tariff Barriers: These are more complex and include quotas, specific health and safety standards, complex export procedures, anti-dumping measures, and local content requirements. Companies must understand why do countries use trade barriers and how they manifest in their specific markets.

- Strategic Compliance: Utilizing modern global solutions can help proactively analyze trade barriers definition and forecast their impact, ensuring compliance before shipping goods.

International trade policy governs the exchange of goods and services between countries

3. The Customs Clearance Process in Import vs Export

Customs clearance is the bottleneck of global trade, and the processes for import vs export are distinct in their administrative requirements.

- Import Clearance: Requires the submission of entry documentation, payment of duties, and inspection. Common questions are: how long does a package take to clear customs? and what does clearing customs mean? The answer often relies on the accuracy of the importer's documents. If documents are insufficient, the shipment may be "picked up by customs clearance company" for correction.

- Export Clearance: Focuses on regulatory approvals and ensuring the goods are safe to leave the country under export procedures. This typically happens quickly unless the item is subject to specific licensing requirements.

3.1. Decoding Customs Statuses: 'Customs Clearance Completed'

A status often searched is what does customs clearance completed mean.

- For Imports, this means the shipment has been released by the receiving country's customs authority, duties have been paid, and the goods are ready for delivery. Following this, the next logical question is after customs clearance how long does it take to deliver?

- For Exports, this means the shipment has met the sending country's export customs clearance requirements and is cleared to depart. If the status is import customs clearance completed, the final leg of the journey has begun.

4. Strategic Operations: The Business of Import vs Export

Beyond compliance, the business models for import vs export companies differ significantly.

- Import Companies: Focus heavily on sourcing, managing foreign supplier relationships, quality control overseas, and navigating the complexities of import regulations upon arrival. They utilize ai analysis to manage cash flow against duty payments.

- Export Companies: Focus on market access, international distribution networks, managing multiple foreign compliance regimes, and optimizing export shipping costs across various export shippers. Finding reliable import export companies or exporters in usa to partner with is key.

4.1. Leveraging AI and Global Solutions for Competitive Advantage

The complexity of import vs export is rapidly being addressed by global solutions leveraging AI:

- AI for HS Code Classification: AI Agents can automatically find HS code with higher accuracy than human operators, reducing errors that cause delays at customs.

- Risk Modeling: Utilizing AI modelling to forecast geopolitical risks, tariff changes, and trade barriers examples allows businesses to adjust sourcing or pricing strategies proactively.

- Logistics Optimization: AI helps compare rates from various export shippers and optimizes routes for shipping goods, providing substantial cost savings in international trade.

AI Agents can automatically find HS code with higher accuracy than human

5. Eximgpt: Your Partner in Mastering Import vs Export

Eximgpt is designed as an ai-powered import/export platform to simplify the entire international trade lifecycle. We provide the tools to transition your business from managing complexities to leveraging global solutions for growth. By automating key tasks like find HS code and managing the documentation for both import vs export procedures, we ensure compliance and efficiency.

Stop guessing and start optimizing. Contact Eximgpt today to transform your import vs export operations into a streamlined, AI-powered competitive advantage.

Related Articles

Avoid costly export classification mistakes! Learn the top 7 errors businesses make and how to ensure compliance for seamless global trade

Bust common lead gen myths! Learn how EximGPT uses AI, sale automation, and import export data to help exporters find real qualified leads.

Email automation refers to the use of software to send pre-scheduled, targeted, and personalized emails to customers and prospects....