Avoid costly export classification mistakes! Learn the top 7 errors businesses make and how to ensure compliance for seamless global trade

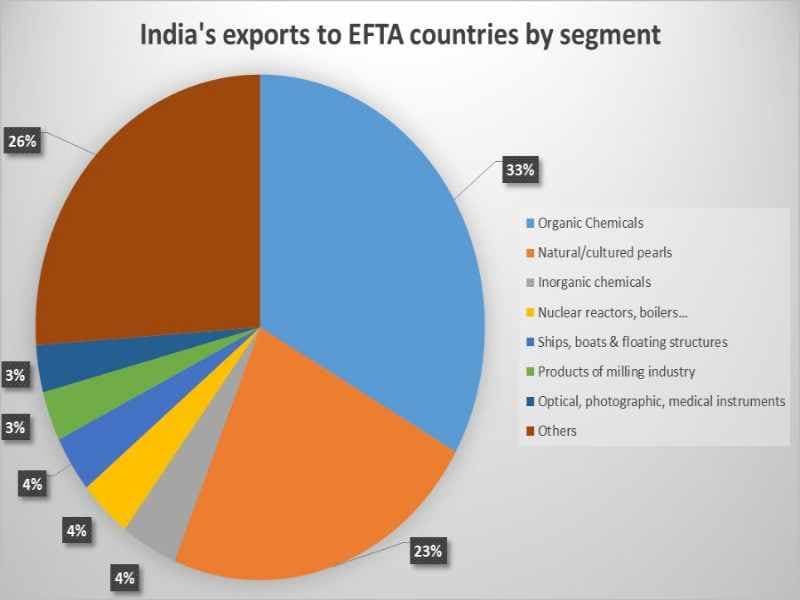

The "Tariff King" label is an unpleasant one, but it has stuck to India for decades - India FTA Strategy. However, as we move through 2025, the narrative is shifting. From the historic India-EFTA (TEPA) agreement to ongoing negotiations with the UK and EU, India is taking optimistic steps toward global integration.

Yet, a fundamental question remains: Is India’s domestic industry ready for the "creative destruction" of global capitalism? While the Commerce Ministry projects $100 billion in FDI and 1 million jobs, critics like NITI Aayog CEO B.V.R. Subrahmanyam warn that India is still trading in goods the rest of the world simply doesn't want.

At a Glance: India’s Trade Readiness

- The Milestone: The India-EFTA (TEPA) deal targets $100B in investment, signaling a departure from old-school protectionism.

- The Structural Gap: 66% of global imports are in sectors where India holds only a 0.2% share.

- The "Three I’s": Future success requires Input liberalization, Incentives, and Infrastructure.

- The Proposal: A dedicated FTA Minister is needed to manage complex regulatory convergence and non-tariff barriers.

On March 10, 2024, India signed the Trade and Economic Partnership Agreement (TEPA) with the European Free Trade Association (Switzerland, Norway, Iceland, and Liechtenstein). This wasn't just a trade deal; it was a signal.

Key Features of TEPA:

However, the challenge lies in Non-Tariff Barriers (NTBs). Because EFTA follows EU-dictated regulatory standards, Indian MSMEs must invest heavily in compliance to actually benefit from these lower tariffs.

In late 2025, NITI Aayog's CEO highlighted a stark reality: India’s export basket is misaligned with global demand.

Category | India's Current Export Focus | Global Demand High-Growth Sectors |

Products | Jute, Tea, Cotton, Low-value Commodities | Electronics, Precision Instruments, Medical Devices |

Market Share | High in sectors making up 3% of global trade | 0.2% share in sectors making up 66% of global trade |

Value Add | Raw Materials / Semi-processed | Global Value Chains (GVCs) & Specialty Chemicals |

To fix this, India must pivot. It isn't just about market access; it's about transforming the product.

While we cut tariffs, our "Bureaucracy King" status remains. Logistics, port delays, and "single-window" systems that aren't truly unified continue to hamper trade.

True value comes from importing components (e.g., semiconductors), adding value (e.g., car dashboards), and re-exporting. This requires the Three I’s:

Global trade thrives on trust. India needs clear Rules of Origin and a judicial system that can resolve trade disputes without decade-long delays.

Our strength lies in niche engineering and specialty chemicals. However, these clusters need regulatory hand-holding to absorb the high costs of global compliance and certification.

Not all FTAs are equal. India should focus on partners where strengths align—such as the UK, ASEAN+6, and Africa—rather than deals that lead to one-sided import flooding.

As the world’s "Services King," India must push for Mode 4 mobility (the movement of skilled professionals) and mutual recognition of degrees in every trade negotiation.

Indian companies must stop fearing competition and start investing in market research, branding, and global partnerships. 1990s-style reforms proved that competition creates champions.

The current muddled bureaucracy is understaffed and spread too thin. India needs a Dedicated FTA Minister with a specialized team to:

In 2019, India walked away from RCEP out of fear. In 2025, the notification of new labor codes and the signing of the EFTA deal suggest a country finally ready to embrace the Schumpeterian mindset: the understanding that for a new, stronger economy to be born, old, inefficient protections must die.

The road to becoming the "FTA King" is long, but the transition from protectionism to proactive capitalism is no longer optional—it is the only way to ensure India's $5 trillion future.

Related post:

Avoid costly export classification mistakes! Learn the top 7 errors businesses make and how to ensure compliance for seamless global trade

Learn how to accurately classify goods with HS Codes, ensuring compliance, reducing costs, and automate trade operations with AI tools like EximGPT.

Exporters need a strategic and data-driven approach to identify and connect with potential buyers...

Among the top AI agents to watch, EximGPT stands out as the leading AI-powered platform designed specifically to empower exporters...

We use cookies

We use cookies to improve your experience, analyse traffic, and deliver personalised content and ads. Essential cookies for security and core functionality are always enabled. By clicking "Accept", you consent to our use of additional cookies.

For more information, see our privacy policy.